Module learning outcomes:

- LO 2 : Understand and explain the purposes of the financial information produced by businesses

- LO 3: Explain the structure and terms used within the main financial statements and undertake the analysis and interpretation of financial statements.

- LO 4: Demonstrate appropriate academic writing skills, referencing and good academic practice and make decisions on organising material in a logical and coherent way with an audience in mind.

Case Study:

Pauline Marriot is the director of Marriot Inns Ltd. The company has traded for 30 years and has in the past achieved very good levels of growth and return on capital, but this is now changing. In recent time it has failed to introduce new product lines, relying on traditional products and little has been invested in New Product Development.

You are a business planning consultant for a firm of Management Consultants. Marriot Inns Ltd is one of your clients. In recent times the business has experienced increased turnover but a downturn in overall performance.

Pauline Marriot has had a meeting with your director and she has stated that she wants to introduce tighter management control within the company by introducing a system of responsibility accounting.

You receive the following memo from your Director, Christina Parks, regarding this case.

Memorandum

To: Business Planning Assistant

Date: 21st May 2021

From: Christina Parks, Director

Subject: Marriot Inns Ltd. – accounts information

You are aware that I met with Pauline Marriot yesterday and that she is concerned with the latest results shown in the final accounts that have recently been prepared at year end.

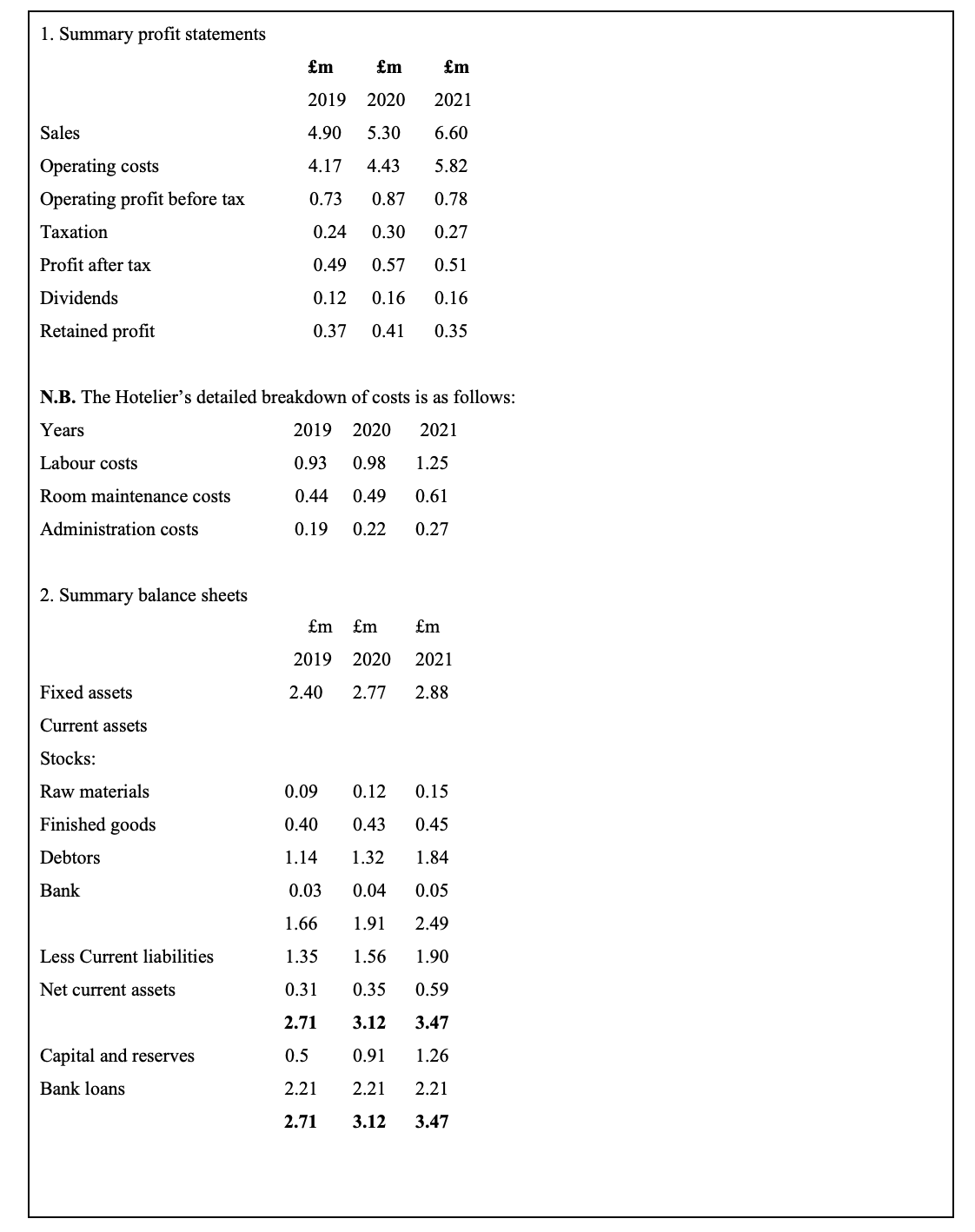

The file attached contains a summary of the company’s abbreviated profit statements and balance sheets for the past three years; together with additional information and performance indicators for their business sector as a whole for the period under review.

I would like you to examine this information and meet with me on Friday morning to discuss the form and presentation of a detailed financial analysis of the company over the three-year period.

Signed: C. Parks

Marriot Inn Ltd Financial information.

DESCRIPTION OF THE TASK – WHAT YOU ARE BEING ASKED TO DO?

-

- Introduction: Define financial information and provide an overview of the aims and objectives of the case study (150 words).

- You are required to clearly explain the purpose of financial information and identify the characteristics of good financial information and explain the key financial terminologies which include income statements, liabilities, and assets. (500 words)

-

- Calculate the following ratios for the Marriot Inns Ltd and compare them with the industry average.(600 words)

- Prepare a detailed report on the company’s performance in terms of profitability and liquidity compared with the average of the sector over the period. (600 words)

- Return on capital employed (%, correct to 1 decimal place)

- Asset turnover ratio (correct to 2 decimal places)

- Net profit margin (%, correct to 1 decimal place)

- Current ratio (ratio, correct to 2 decimal places)

- Acid test ratio (ratio, correct to 2 decimal places)

- Debtors’ collection period (days, correct to an integer)

- Gearing ratio (%, correct to 1 decimal place)

- Labour cost as % of sales (%, correct to 1 decimal place)

- Operating costs as % of sales (%, correct to 1 decimal place)

- Room Maintenance costs as % of sales

- Administrative costs as % of sales

Conclusion: Consolidate the key findings and overall remarks and suggestions (150 words)

Tags: assignmentexpert, assignmenthelp, assignmenthelpaustralia, assignmenthelper, assignmenthelpuk, assignmenthelpusa, assignmentwriting, bestpriceguaranteed, bestqualityguaranteed, london, myassignmenthelp, plagiarismfreework